- Blog

- Hits: 89241

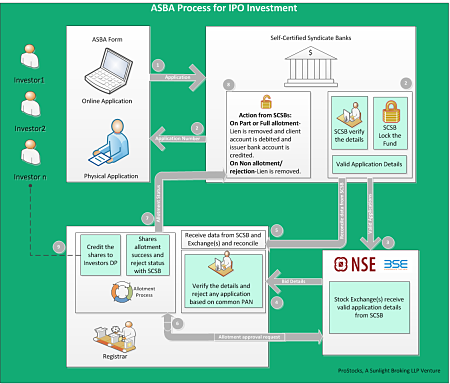

ASBA Application for IPO Investment

IPO Investment

In Jan 2016, SEBI made it mandatory for all application in IPO and FPO ( Initial Public Offering and Follow on Public Offering ) to be through ASBA (Applications Supported by Blocked Amount) in which Bank of the client has to create lien ( block the amount in bank account) in favour of the Issuer. Upon allotment, lien will be removed and Client bank account will be debited to the extent of allotment amount. This solves problem delay in refund of IPO application amount upon none or part allotment. Issuer will be given amount post allotment by the Bank to the extent of allotment amount.

IPO application through cheque payment is no longer allowed. Now Stock Broker is not able to offer paperless application to client through their trading website.

Now all paperless ASBA application are possible through your bank account. Majority of the bank’s allowing their client to make IPO ASBA application from their online bank account. Client having account in those bank account who are not offering paperless ASBA application or those client who do not do online banking has to fill the physical application and submit to syndicate member for onward submission to client’s bank for creating lien marking in the client ‘s bank account.

Before 2016, broker was taking IPO application from its client along with cheque and submitting to Registrar. In that process, investor’s money was collected by the issuer and in case of over subscription, they have to refund the amount. Collecting funds even before allotment and refund in case of non allotment was time consuming process and there were many complaints from investors for non refund, delayed refund , time taken for listing due to manual process etc . ASBA has solved all such issues and also investor is able to earn interest as money is lying in their own bank account till allotment, Listing time has shortened etc.

Let’s discuss how ASBA (Applications Supported by Blocked Amount) process works

With ASBA process, banks need to be part of Self-Certified Syndicate Banks (SCSBs). Once bank receive approval as SCSB, they can take IPO application physically on their branches or provide an online IPO investment platform through net banking facility.

ASBA process is applicable to all book-built public issues provided only one payment option by retail individual investors.

Each Self-Certified Syndicate Bank is authorized to accept IPO application which requires Applicant Number, PAN Number, DP Number, Bid Quantity details.