- Blog

- Hits: 51112

Stamp Duty Demystified

Stamp Duty on Transaction at Stock exchange and transfer through Depositories

The Government of India amended the Indian Stamp Act, 1899 through Finance Bill 2019 presented in the Parliament on 1st February 2019. Amended provisions were to be effective from the date of notification, to be issued in the official Gazette of India.

The Government of India has published a notification in the Official Gazette of India on 10th December 2019 making the amended provisions effective from 01 July 2020.

What is chargeable :

|

Sr.No |

Item Description |

Chargeability after 01 July 2020 |

Chargeability prior to 01 July 2020 |

|

1 |

All transactions executed at, as well as reported to the recognised Stock and Commodity Exchanges generally known as Contract Note transaction |

Chargeable |

Chargeable |

|

2 |

Any transfer of securities for consideration through Depository other than 1 above, like issuance of shares and securities by the company, off-market buy and sell etc. |

Chargeable |

Not chargeable |

|

3 |

Gifts, collaterals towards margin to stock-broker or to Banks or NBFC for borrowing, early pay-in shares etc (transfer for and return thereof) will not be liable for stamp duty |

Not chargeable |

Not chargeable |

|

4 |

Bonus Shares, Split of shares etc without consideration |

Not chargeable |

Not chargeable |

|

4 |

Government Securities |

Not chargeable |

Chargeable |

What rate and Who, whom and When is liable to pay :

|

S r No |

Item Description |

Rate of Stamp Duty |

Who is liable to pay |

Whom to Pay on behalf of state Govt |

When is liable to pay |

Old rates at Maharashtra |

|

1 |

Equity Segment (Capital Market) Non delivery (intra-day) trades across Stock Exchanges except debentures and Govt Securities |

0.003% |

Buyer |

Stock Exchange / CCs |

On settlement |

0.004% (0.002% each for buyer and seller) |

|

2 |

Equity Segment (Capital Market) delivery trades across Stock Exchanges except for debentures and Govt Securities |

0.015% |

Buyer |

Stock Exchange / CCs |

On settlement as delivery and not closeout |

0.02% (0.01% each for buyer and seller) |

|

3 |

Equity and Commodity Futures |

0.002% |

Buyer |

Stock Exchange / CCs |

On settlement |

0.004% (0.002% each for buyer and seller) |

|

4 |

Equity and Commodity Options on premium value |

0.003% |

Buyer |

Stock Exchange / CCs |

On settlement |

0.004% (0.002% each for buyer and seller) |

|

5 |

Futures and Options on Currency and Interest rates |

0.0001% |

Buyer |

Stock Exchange / CCs |

On settlement |

0.004% (0.002% each for buyer and seller) |

|

6 |

Government Securities |

Nil |

NA |

NA |

NA |

0.001% (0.0005% each by Buyer and Seller) |

|

7 |

Issue of securities including debentures |

0.005% |

Issuer |

Depository |

At the time of credit to Depository |

Nil |

|

8 |

In case of Debenture reissue |

0.0001% |

Issuer |

Depository |

At the time of credit to Depository |

Nil |

|

9 |

In case of transfer of Debenture against off-market trade or delivery trades |

0.0001% |

Seller / Transferor |

Depository |

At the time of transfer |

Nil |

|

10 |

In case of transfer of Debenture pursuant to Trade at Stock Exchange (Delivery Trades) |

0.0001% |

Buyer |

Stock Exchange / CCs |

At the time of settlement |

0.0005% |

|

11 |

Open-offer, Buyback, Offer for Sell etc through Stock Exchange Platform |

0.015% |

Acquirer / Seller |

Stock Exchange / CCs |

On settlement as delivery and not closeout |

0.02% (0.01% each for buyer and seller) |

|

12 |

Transfer of any Equity and Equity related securities for consideration, made through depository, otherwise than on the basis of any transaction on Stock and Commodity Exchanges

|

0.015% |

Seller / Transferor |

Depository |

At the time of transfer |

Nil |

S P Toshniwal

Founder and CEO

www.prostocks.com

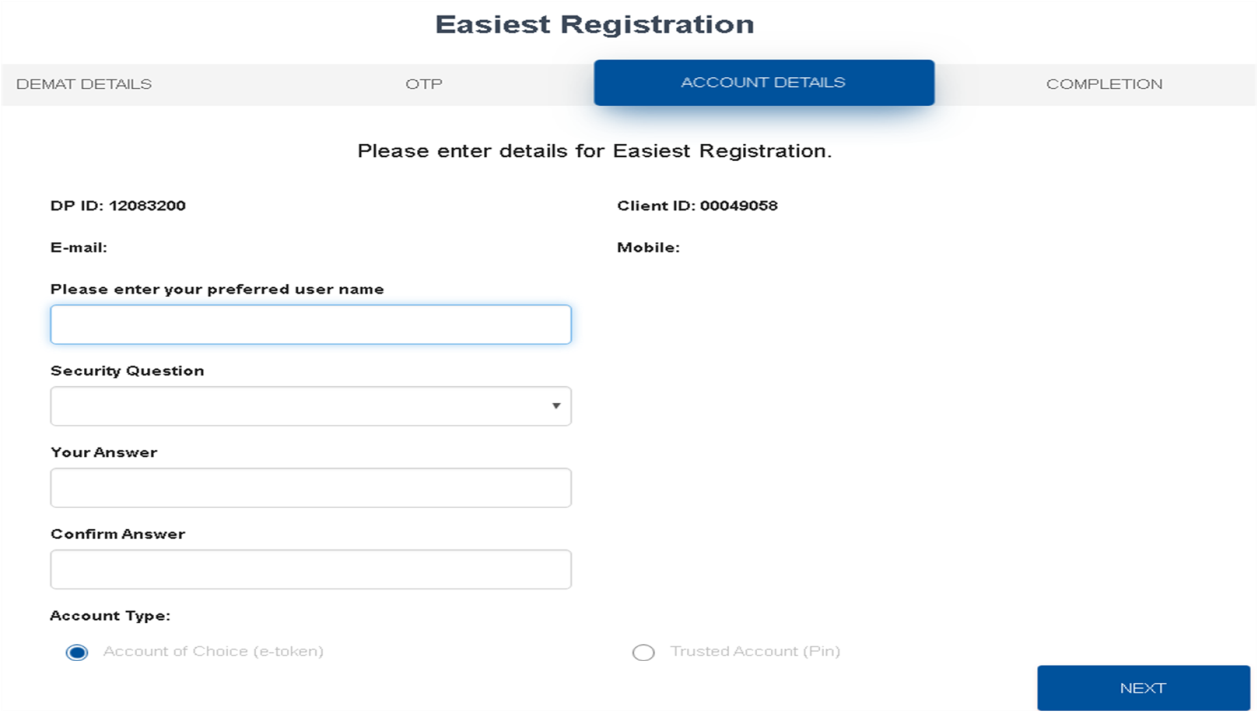

In case of trusted account registration two message will be available to the BO/Demat Account holder at the end of the registration “Registration request forwarded to the DP for authentication” and “Duly signed trusted account holders forms to be submitted to the DP for authentication of trusted account holders” and only trusted account declaration form and/or grouping form [if any account is grouped during registration] will be available to the BO for download.

In case of trusted account registration two message will be available to the BO/Demat Account holder at the end of the registration “Registration request forwarded to the DP for authentication” and “Duly signed trusted account holders forms to be submitted to the DP for authentication of trusted account holders” and only trusted account declaration form and/or grouping form [if any account is grouped during registration] will be available to the BO for download.