Starting 1st Oct 2020, Clearing Corporations(CCs) is taking 4 snapshots of client position and margin thereof at random intervals. CCs are providing these Peak margin files Stock-Brokers / Clearing Members (TM/CM) to ensure that they are collecting margin upfront to meet the requirement of Peak Margin. This is in addition to existing Margin Collection, Reporting and Penalty requirement for end of the Day Margin Reporting.

Starting 1st Dec 2020, Clients would be subject to Peak Margin requirement as well as End of Day (EOD) Margin requirement. Short-fall in Peak Margin or EOD Margin would be subject to penalty at prescribed rates along with 18% GST.

The penalty would be collected by Clearing Corporations from Client through Stock-Brokers / Clearing Members.

What has changed at ProStocks :

- Effective from 1st March 2021, Client selling delivery from Demat Holding will get 50% (70% between 1st Dec 2020 to 28 Feb 2021) Credit for Sale (CFS) on a real-time basis in Trading Application instead of 100% (Prior to 1st Dec 2020), in all the three Trading Platform which we have, Namely PROSTOCKS, PRO AND BEST. Remaining 50% CFS will be available from next day.

- Client selling delivery from previous day's buy position, also known as T1 Holding or BTST or Stocks to be received (SR) will get 50% CFS on a real-time basis in PROSTOCKS AND PRO Trading Application and Zero (NIL) instead of 100% CFS (Prior to 1st Dec 2020), they were getting so far. Remaining 50% CFS will be available from next day.

Why 70% CFS or 50% CFS instead of 100%

NSE allowed that Client's margin can be considered equal to 100% of the sale value once Early Pay-In of Securities sold by the Client through NSE Circular and Annexure A NSE/INSP/45191 dated July 31, 2020.

............However, in respect of sale of shares by a client for which early pay-in has been accepted by CC, since settlement of the trade is guaranteed by the CC, member may choose to give credit of the sale value of the shares in the ledger account of the client, which may be considered as margin towards subsequent trade/s of the client.

NSE by Download Ref No: NSE/INSP/46485 and Circular Ref. No: 72/2020 dated November 27, 2020, just a day prior to Peak margin Penalty provisions coming into effect has modified the above-said clarification/guidelines by an answer to question 1 of Annexure A of the said circular:

........However, the sale value of such securities (EPI value), as reduced by value of the 20% upfront Margin, shall be available as Margin for other positions across all the segments

Care and Caution for Client Trading on BEST Platform for Derivatives and availing In-built Hedge Margin Benefit( HMB)

Whenever you are removing hedge or sq off or changing the portfolio, Please extremely careful to first sq off the higher margin / naked or risky leg before you sq off the leg which created the hedge or reduced the risk and or Margin.

Example: Assume you have available Margin of Rs 1,60,000 and one lot NIfty Call Buy position for which you have blocked/ paid margin of Rs 10,000. Now you want to sale one lot of Nifty Futures for which margin is Rs 1,60,000. Instead of you getting charge margin of Rs 1,70,000, You were subject to a margin of just Rs 17,000 ( which is 10% of actual margin otherwise payable) for both the position, together and got HMB of Rs 1,53,000. Post this position, now you have an available margin of Rs 1,53,000. Further, assume that you bought delivery of Rs 1,50,000 from the available margin of Rs 1,53,000 and the now available margin is Rs 3,000.

Now if you go ahead and do sale / sq off of one lot Nifty Buy Call leaving one lot Nifty futures sale as naked/unhedged position and margin requirement for this position is Rs 1,60,000 against available Margin of Rs 13,000 ( Rs 3000 plus RS 10000 from sale of Call Option) leaving Margin Shortfall of Rs 1,47,000.

Be extremely careful to sq off the naked leg first which in this case was Nifty Future Sale position before you sq off leg which created hedge. In case of Margin shortfall even of peak margin and even for a few seconds, You are expressly agreeing to agree to bear the penalty and consequences thereof.

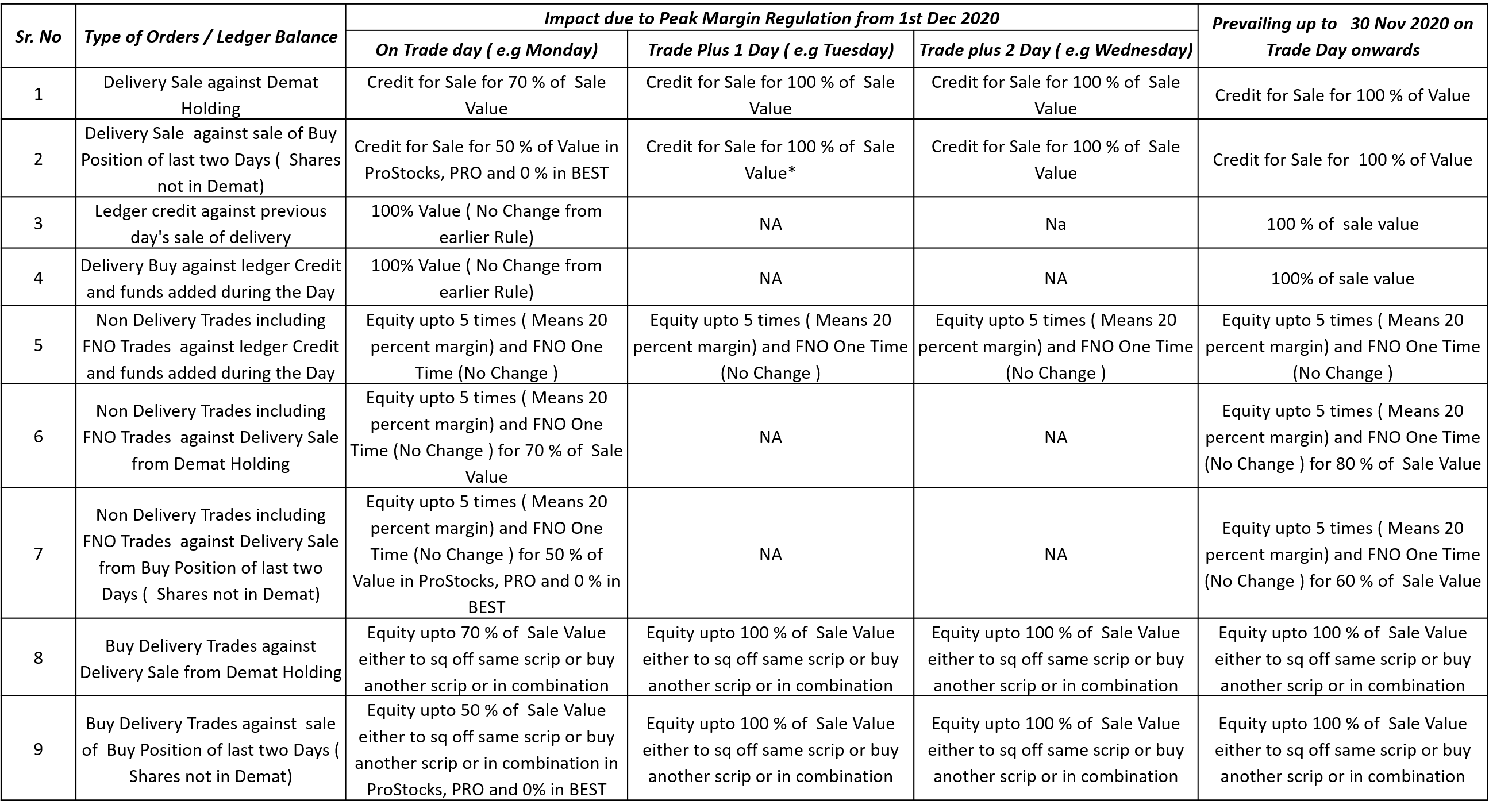

Impact of Peak Margin Reporting effective 1st Dec 2020 on Resident Indian Client using the PROSTOCKS, PRO and BEST Trading Platform

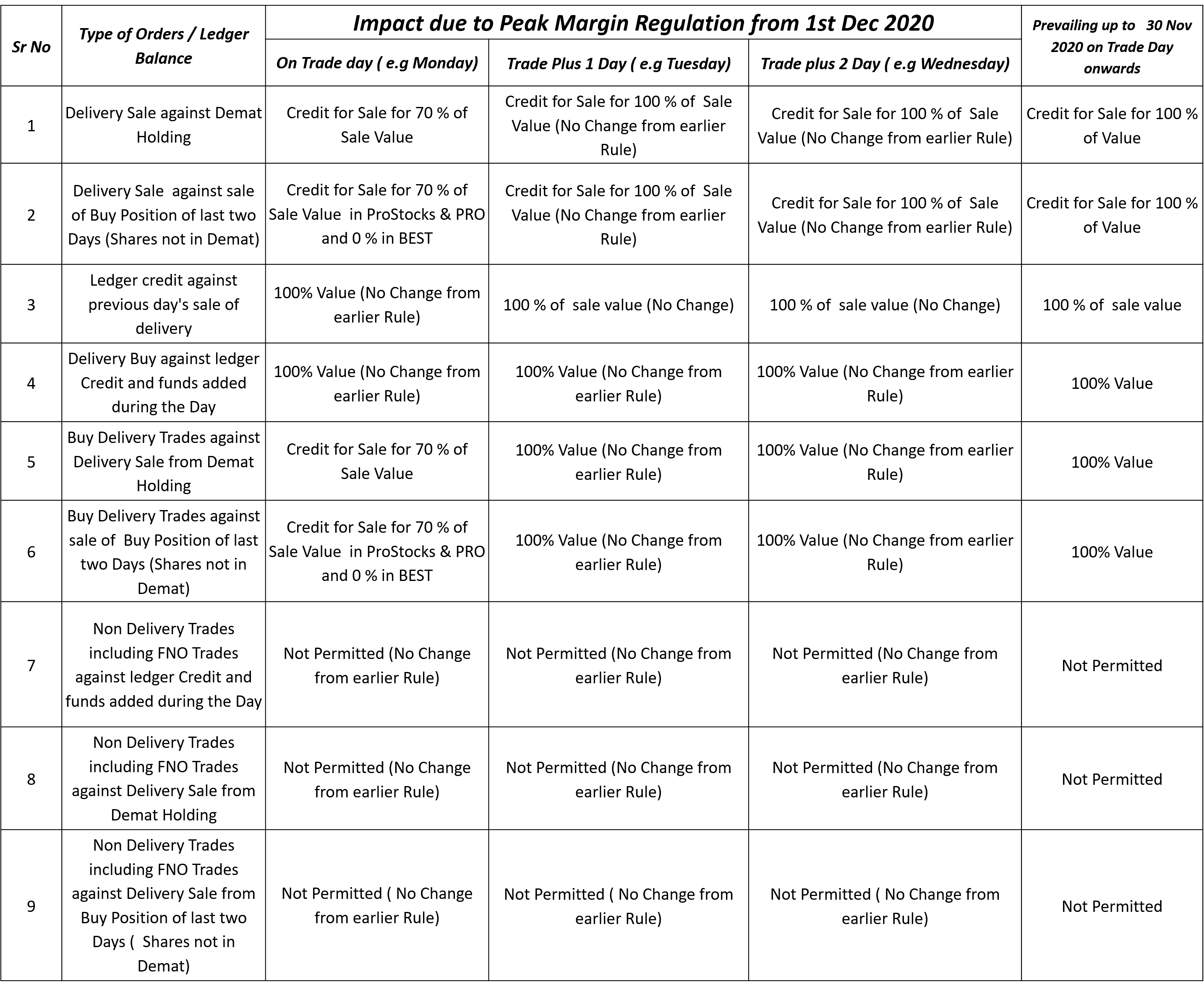

Impact of Peak Margin Reporting effective 1st Dec 2020 on Non Resident Indian Client having NRE Trading and Demat Account linked with NRE PIS Bank Account and using the PROSTOCKS , PRO and BEST Trading Platform provided by ProStocks

NRI Client buying against sale of delivery or against PIS Bank balance has to ensure that their Bankers makes us payment by Trade Plus 1 Days. Most Banks including HDFC Bank has allowed NRI to debit their PIS Bank Account and credit Sunlight Broking LLP ( ProStocks 's Bank Account with respective Banks).

In case funds are not received by Settlement Date ( Which is Trade plus Two Trading Days) , Exchanges / Clearing Corporation will levy penalty of 1.18 % ( 1 percent plus 18 percent GST on 1 percent) of shortfall amount for two days, so this will be 2.36 percent for the shortfall amount.

ProStocks will recover from client and will make the payment to Exchanges/ clearing corporation.

Impact of Peak Margin Reporting effective 1st Dec 2020 on Non Resident Indian Client having NRO NON PIS Trading and Demat Account linked with NRO Savings Bank Account and using the PROSTOCKS , PRO and BEST Trading Platform provided by ProStocks

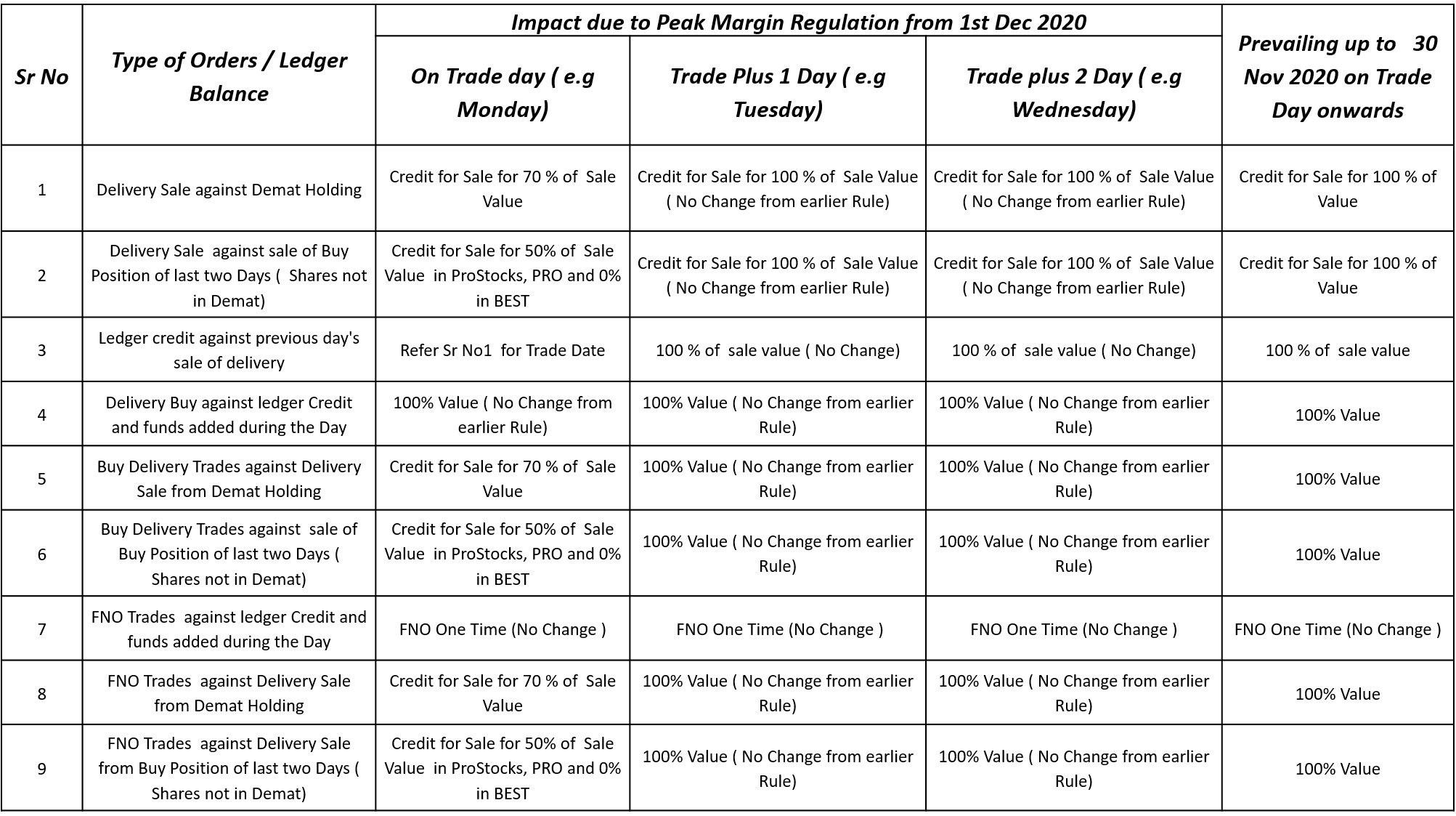

Peak Margin Reporting and its Impact effective 1st September, 2021

S P Toshniwal

www.prostocks.com

+91-22-62434343