Yes.

Your investment in India through the Stock Market is governed by the following regulation:

- Foreign Exchange Management Act (FEMA) supervised by RBI

- Income Tax Act, 1961 supervised by Income Tax Department, Govt. of India

- SEBI regulation for Exchanges, Stock Broker and Depository

You can invest on Repatriable Basis (NRE) or Non-Repatriable Basis (NRO) or both.

When you open NRE PIS Bank Account: Your Bank provided you with the following THREE services besides usual banking Services:

- Applying to RBI and taking PIS (Portfolio Investment Scheme) permission. This is a one-time activity. This is a requirement under FEMA.

- Reporting all your transaction routed through PIS Bank Account to RBI on a regular basis. This is a requirement under FEMA.

- Calculating, Deducting and Depositing you tax liability arising out of shares sold through PIS Trading Account and proceeds credited to PIS Bank Account. This is required due to Section 195 of the Indian Income Act,1961.

FEMA has been amended in Feb 2016, and NRI investing through Non-Repatriable Basis (NRO) route are not required to take PIS permission and hence no requirement of reporting transaction to RBI.

In a nutshell, Service Number 1 and 2 mentioned hereinabove are no longer required for NRO Account. However, Service Number 3 is still applicable.

Banks are willing to provide Service Number 3 as mentioned hereinabove for NRO Account BUT at the same taking charges which they are taking for NRE PIS Account. In such case, your Banker will open your normal NRO Saving Bank Account, will insert Dummy PIS permission Number, so their software will behave as if this is PIS account and will rename this as NRO Investment Account and will provide you Tax Deduction Service.

ProStocks is now bring to you NON PIS NRO Trading Account.

ProStocks will do compliance of Section 195 of Indian Income Tax Act, 1965 for a fixed fee of Rs 1k p.a (waived for account opened before 31st March, 2023) and you would be able to trade in equity segment just like Resident Indian. No Custody Account, No hassle of dealing with Custodian or PIS Banker besides Stock Broker. No PIS Bank Account required.

What are the documents required for opening an NRO Account?

Following are the document required for opening NRO Trading and Demat account:

- Attested copy of PAN card,

- Attested copy of overseas address proof – Copy of Driving License/Foreign Passport/Utility Bills/Bank Statement (not older than 2 months)/Notarized copy of rent agreement/Leave & License agreement/ Sale Deed. NRI residing in Gulf countries and not having any of the above overseas address proof can give Declaration of P.O. Box in your residing country,

- Self-certified copy of Indian address proof, if any. Providing Indian address in KYC is voluntary. You may provide for your own benefit.

- Passport size photograph

- In case of an Indian Passport: Attested copy of valid passport with copy of Valid Visa

- In the case of Foreign Passport: Attested copy of valid passport, Copy of PIO/OCI card.

- Proof of Bank account (a cancelled cheque leaf of your NRO savings bank account)

Note 1 : Copy of PAN card, Passport, Power of Attorney and Foreign address proof are required to be attested. Attestation can be done by the Indian Embassy or any other competent authority like Consulate General or Notary Public or Overseas Banker or Indian Banker. The attesting authority should affix a “verified with original” stamp, name, designation, signature and date on the said documents.

Note 2 : Attestation is not required when your KRA status and IPV status is Y (Yes) and no change is required from your previous KRA. For checking your KRA status go to KYC inquiry menu on www.cvlkra.com

Can I convert my existing NRO Trading and Demat Account linked to NRO PIS Bank Account to Non-PIS NRO Trading Account?

Yes

Just send email to [email protected] to convert their NRO Trading and Demat Account to NON PIS Account.

You will trade like Indian Resident Account. Yes exactly like Resident Indian except two exception:

- Your account is subject to withholding tax

- You cannot do intra-day trades in equity segment.

You will add funds in your trading account just like resident Indian account and also withdraw funds. Funds withdrawal may take processing time of one working day to calculate withholding tax.

You can add Equity Futures and Options also in same Trading Account by filling one pager Segment Activation Form and one pager Custodial Participant (CP) Code Application Form

NRO Account for Equity Delivery Trades :

ProStocks will map NRO Saving Bank Account with your NRO Trading Account. You can have many NRO Saving Bank Account with same Bank or many Banks and all can be mapped to your Trading Account for transferring funds to ProStocks. You can have NRO Savings bank Account in any Bank of your choice and there are no restrictions on the number of Bank-supported. You will operate your NRO Saving Bank Account for equity trades like Resident Indian. You can transfer funds to us any time, you can withdraw your funds from ProStocks any time with just one exception, compliance of Section 195 of the Indian Income Tax Act, 1965 with regard to withholding tax (TDS).

You will also need to open NRO Saving Bank Account. You no longer required to open NRO Invest Account (similar account was earlier called NRO PIS Bank Account). ProStocks can assist you in opening your Bank Account. No PIS Bank Account required.

The dividend will be credited to your NRO Savings Bank Account ( Primary Bank Account, in case of more than one Bank Account) by the respective companies whose shares are held in your NRO Demat account on the record date for dividend.

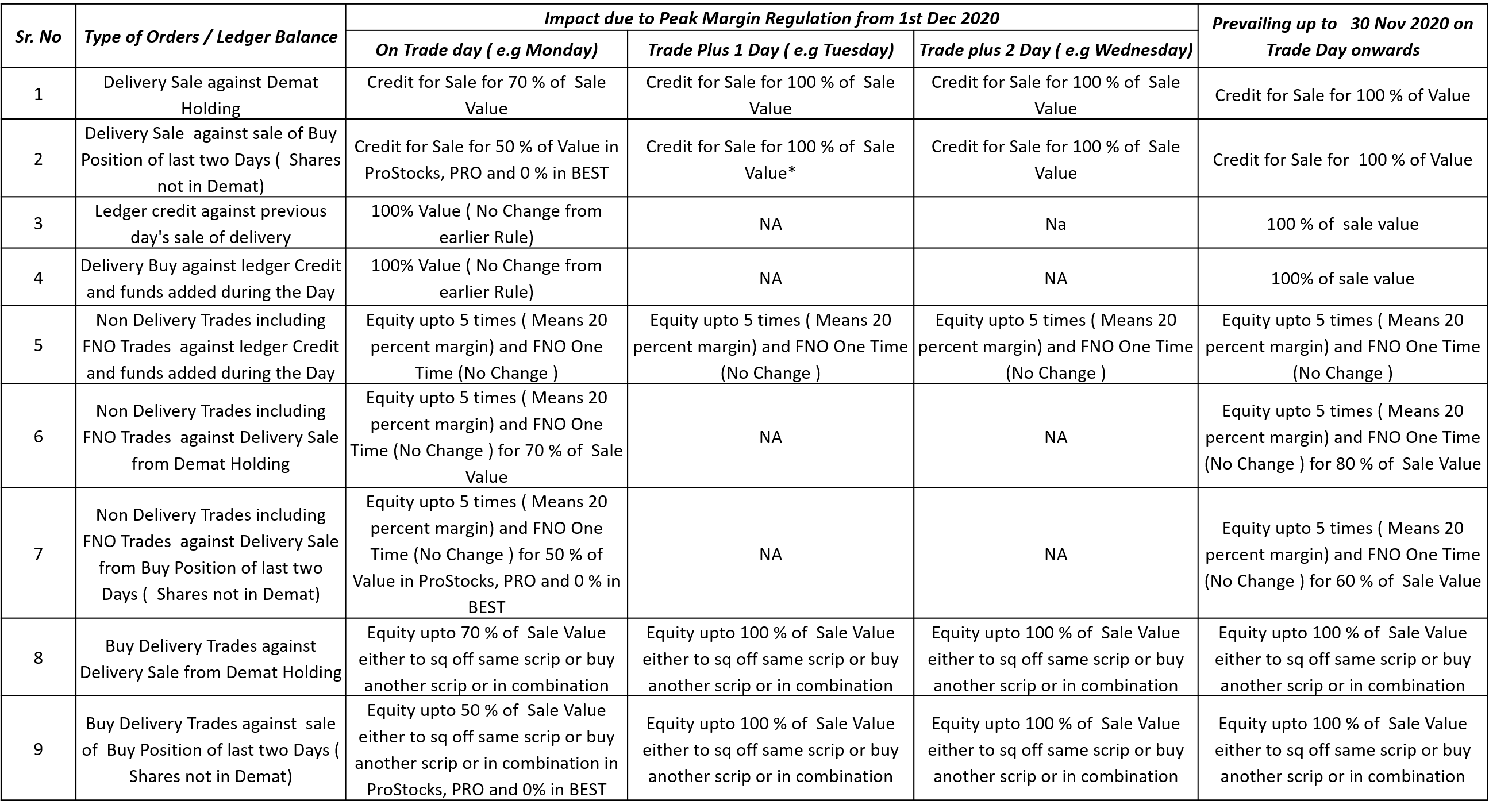

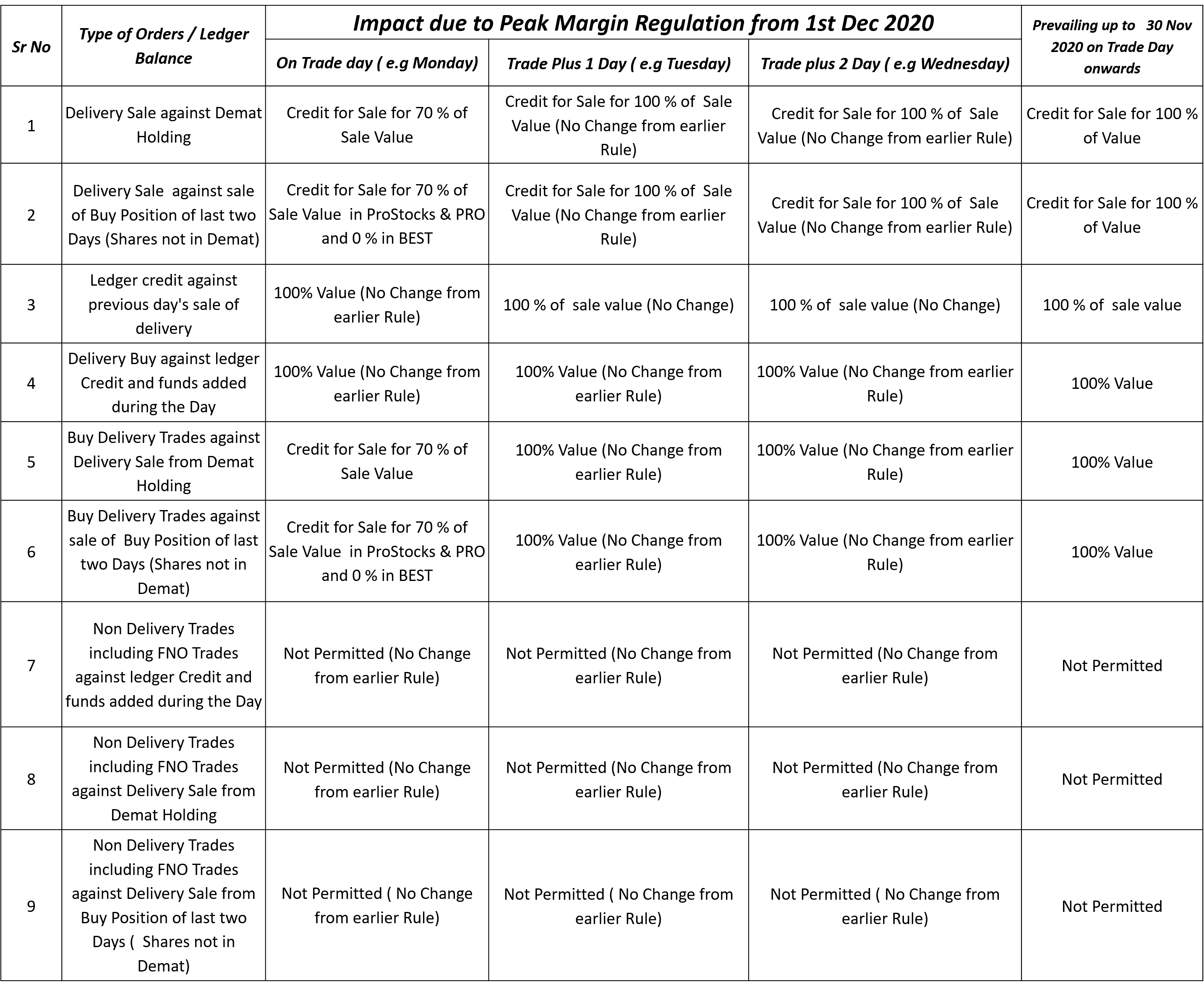

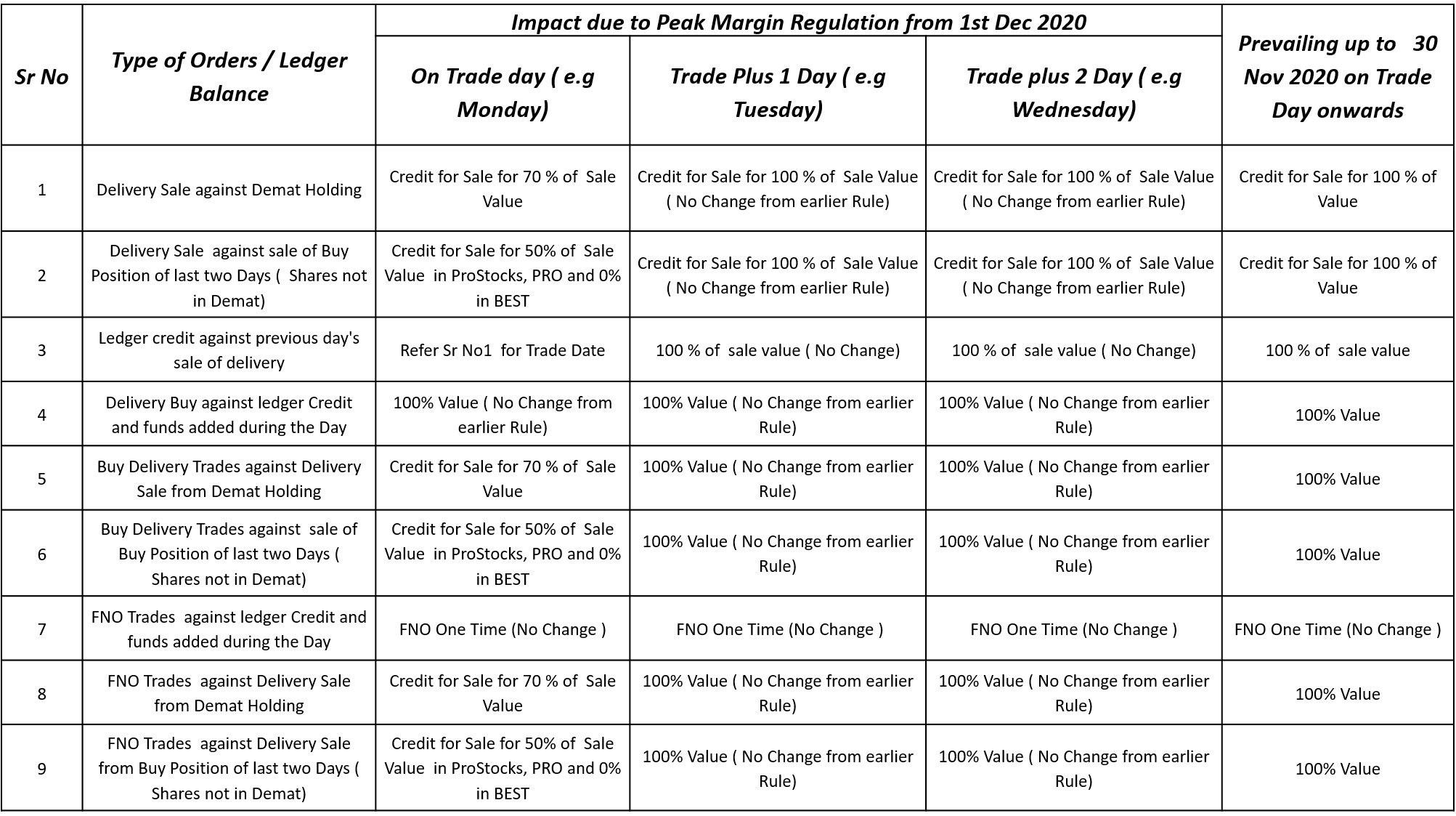

You need to transfer funds from your NRO Savings Bank Account before buying. Once you buy, ProStocks will send you contract note same day and credit shares to your Demat Account on securities payout day. Generally you are expected to sell after shares credited to your Demat Account and not before. You can buy shares next day against credit to be received in your trading account on funds payout day of previous day's sale minus withholding tax liability, if any.

Similarly, when you sell the shares, ProStocks will send you contract note same day and credit your Trading Account with us on funds payout day. You can buy shares next day against credit to be received in your trading account on funds payout day of previous day's sale, minus withholding tax liability, if any. RBI reporting is not required for NRO Account after February 2016 but compliance of Section 195 of the Indian Income Tax Act, 1965 with regard to withholding tax (TDS) is required.

ProStocks will do compliance of Section 195 of Indian Income Tax Act, 1965 for a fixed fee of Rs 1k p.a (waived for account opened before 31st March, 2023) and you would be able to trade in equity segment just like Resident Indian. No Custody Account, No hassle of dealing with Custodian or PIS Banker besides Stock Broker. No PIS Bank Account required.

NRO Account for Equity Futures and Options (Derivatives) Trades

You will need to open NRO Saving Bank Account. ProStocks can assist you in opening your Bank Account.

ProStocks will map NRO Saving Bank Account with your NRO Trading Account. You can have many NRO Saving Bank Account with same Bank or many Banks and all can be mapped to your Trading Account for transferring funds to ProStocks. You can have NRO Savings bank Account in any Bank of your choice and there are no restrictions on the number of Bank-supported. You will operate your NRO Saving Bank Account for equity derivatives trades like Resident Indian. You can transfer funds to us any time, you can withdraw your funds from ProStocks any time with just one exception, compliance of Section 195 of the Indian Income Tax Act, 1965 with regard to withholding tax (TDS).

ProStocks will do compliance of Section 195 of Indian Income Tax Act, 1965 for a fixed fee of Rs 1k p.a (waived for account opened before 31st March, 2023) and you would be able to trade in equity futures and options just like Resident Indian. No Custody Account, No hassle of dealing with Custodian besides Stock Broker.

You are no longer required to open custody or custodial account with ISSL or anyone when you do equity derivatives trades through ProStocks. Since you are not required to open Custody Account, you will save a significant amount, which was otherwise, you were required to pay to Custodian. ProStocks will take your CP code from the exchange which will allow you to trade equity derivatives at NSE as well as BSE.

WhatsApp support for NRI. Send opt in request using this link

SP Toshniwal

B50, B Wing, 3rd Floor ,Pravasi Estate Goregaon Mulund Link Road

Goregaon East Mumbai 400063 +91-22-62 43 43 43 www.prostocks.com

Hits: 39916