ProStocks F&O Margin Calculator »

ProStocks F&O Margin Calculator is an online real-time margin calculation tool for NSE Equity Futures and Options. It provides detail break up of margin component for futures trading, option writing/shorting and multi-leg F&O strategies. This calculator provides break up of margins including span margin, premium margin, calendar spread charge, exposure margin, additional exposure margin due to increase in Market Wide Position Limit (open interest) and hedge/spread benefit.

The data of the Margin Calculator is refreshes 5 times during the trading day as changed by the Exchanges.

The Advance Margin Calculator by ProStocks helps traders with:

- Margin benefits for taking calendar spreads (taking opposite positions on different expiry of the same contract)

- Option writing margins

- Margin benefit for various multi-leg hedged option strategies

- Additional exposure margin applicable or not. If applicable, how much and on which scrips?

How does F&O Margin Calculator work?

1. Index Futures & Stock Futures Margin

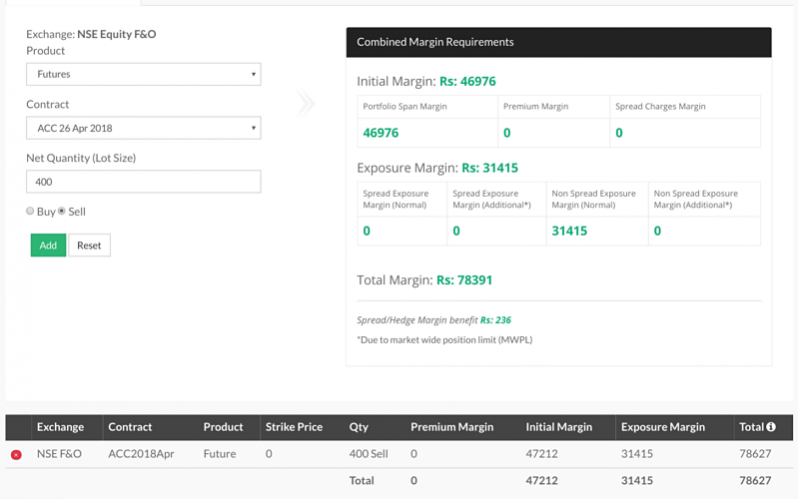

The total margin for Index or Stock Futures is derived as below.

Total Margin = Span Margin + Exposure Margin

Total Margin (or delivery margin) is the margin required to hold the position overnight. Note that ProStocks customers get additional leverage for placing intra-day orders. Read ProStocks Exposure FAQs and Limit related FAQ.

Let's take an example of selling one lot of ACC Futures of April 2018 Expiry. The calculator makes it simple to calculate the margin on the real-time basis.

2. F&O Calendar Spreads Margin

Futures Calendar Spread is a simultaneous purchase of futures expiring particular date (month) and selling futures expiring another date (month).

Options Calendar Spread is a simultaneous purchase of options expiring particular date (month) & strike price and selling options expiring another date (month) but with the same strike price.

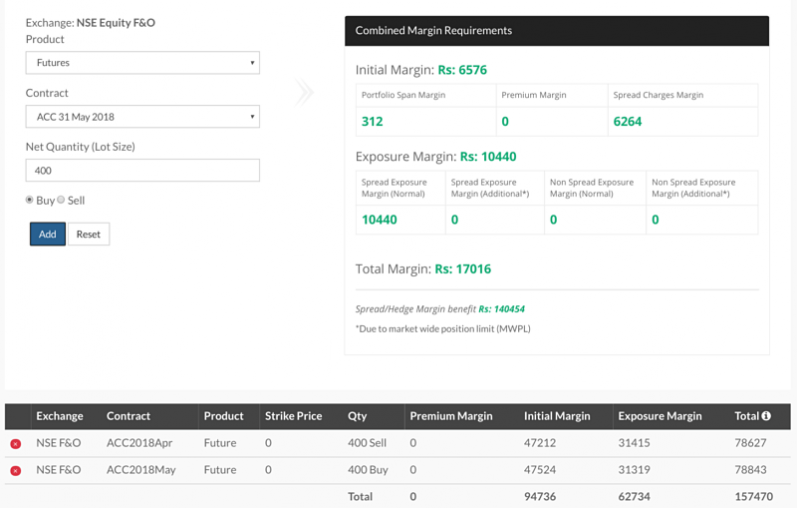

The calendar spread offers additional margin benefits as the position is hedged.

The Total Margin for F&O Calendar is derived using the formula as below:

Total Margin = Span Margin + Calendar Spread Charge + Exposure Margin

The calculator also shows the margin benefit due to spread/hedge.

Let’s take an example of a calendar spread between selling one lot of ACC April 2018 expiry and Buying one lot of ACC may 2018 Expiry Future. The calculator allows adding two positions and shows the detail margin requirements.

3. For Option Writing/Shorting Margin

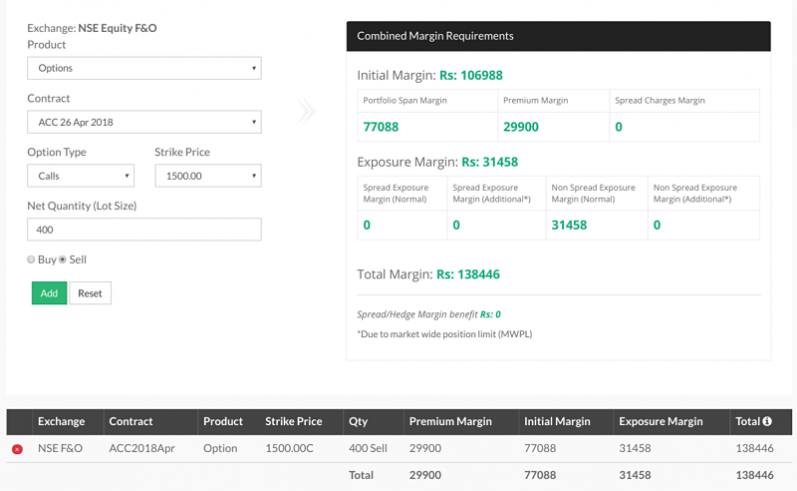

Initial margin (or span margin) for options is the higher of span margin requirements. The margin for options varies by the type of the option (call/put), strike price and time to expiry for the given stock or index.

The total margin is calculated as below.

Total Margin = Span Margin + Premium Collected + Exposure Margin

The premium collected gets credited to customers financial ledger balance and the actual margin required to be brought in will come down by that amount. ProStocks F&O Margin Calculator shows this as Premium Margin based on very recent span file provided by the exchange 5 times a day. Note that we do not show this based on the closing price of options from the previous day.

The screenshot below shows the margin required for writing one lot of call option of 1500 strike price of ACC expiry April 2018. The margin required to write is Rs. 1, 38, 446 but once you take this position Rs 29,900 is credited to your trading account effectively blocking only Rs 1,08,546 for this position.

4. Multi-Leg F&O Strategies Margin

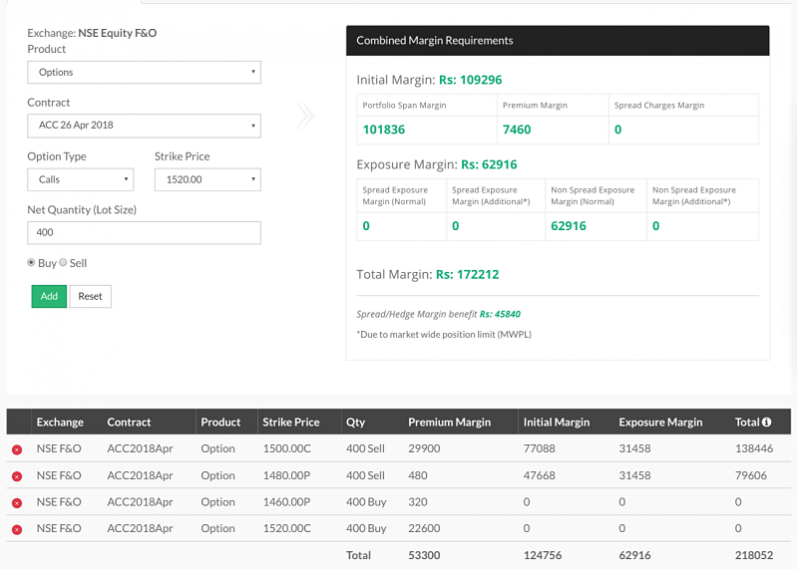

There are many popular multi-leg F&O strategies like Straddles, Strangles, Iron Condors, Butterfly, Bull Call Spreads, and Covered Calls. These strategies involve taking more than one positions at a time. The margin required for such a combined position could be less than the sum of individual margin requirements as the positions hedge each other. The total margin for this is calculated as below:

Total Margin = Span Margin + Premium Collected + exposure margin

Note that the Spread Benefit availed is shown separately in the calculator.

Let’s take an example of calculating the margin for an Iron Condor Strategy. This strategy involves 4 legs.

ACC is being traded at Rs 1490 (Spot Price). The strategy includes:

- Sell 1 OTM Put – Short 1 lot of 1480 Put

- Buy 1 OTM Put (Lower Strike) – Buy 1 lot of 1460 Put

- Sell 1 OTM Call – Short 1 lot 1500 Call

- Buy 1 OTM Call (Higher Strike) – Buy 1 lot 1520 Call

ProStocks F&O Span Margin Calculator shows the margin required and the benefit of entering this strategy. The margin is calculated in real-time basis using the span file provided by the exchange.

ProStocks F&O Margin Calculator »